Concentrate in Accounting

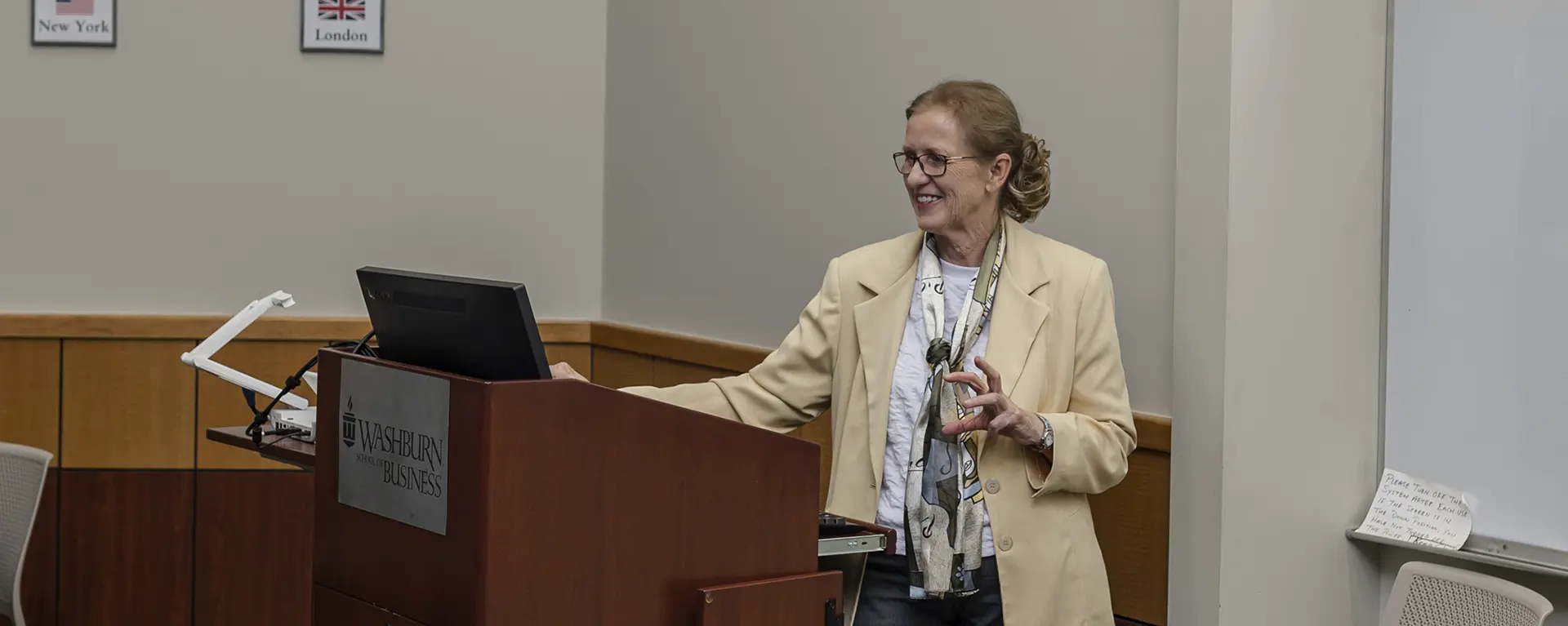

Accounting is much more than simply the organization of financial data. It is the application of analytical reasoning, critical thought, problem solving and decision making. At Washburn, you will discover the intricacies of all accounting tasks, from conducting audits and managing financial accounts, to preparing taxes and developing accounting information systems. Combining your solid math skills, eye for detail and keen intellect, you will be prepared for a challenging and fulfilling career.

BBA in Accounting

A BBA in Accounting from Washburn University can unlock hundreds of job opportunities in virtually every sector of the economy for preparation in these five main fields:

- Public Accounting (CPA)

- Industrial/Corporate Accounting

- Non-Profit Organizations

- Governmental Agencies

- Higher Education

Washburn Business students routinely score in the 95th percentile on the Major Field Test (MFT) in accounting. The MFT is a national, standardized exam given to more than 550 U.S. business schools.

The Brenneman School of Business is accredited by AACSB, a distinction bestowed upon only the top 6% of business schools nationwide.

Our students also benefit from small class sizes which allows an opportunity to build relationships with Washburn professors. Our faculty and staff are actively involved in connecting students to accounting internships and employers who need full-time employees – good businesses who are looking for great accountants.

Attending full-time, you can complete your undergraduate degree in four years.

Fast-Track Your Master of Accountancy Degree

For students who are interested in graduate studies, Washburn offers the 3 + 2 MAcc program. Specially designed for undergraduate students, this program allows students to work toward both their Bachelor of Business Administration in Accounting and Master of Accountancy. At 150 credit hours, the 3 + 2 MAcc program also fulfills all the requirements necessary to sit for the CPA exam in Kansas.

Becoming a CPA in Kansas

Becoming a Certified Public Accountant, or CPA, is a substantial upgrade to your BBA in Accounting. This popular career path almost always has a higher position in financial and business circles, and CPAs are capable of advising on a company’s financial aspects primarily in three areas: income tax, auditing and management services.

If your goal is to become a CPA, Washburn can put you on the right path. All courses in our Accounting degree program count toward fulfillment of the requirements necessary to sit for the CPA exam. To fully qualify to sit for the CPA exam, you only need to complete an additional 30 hours of related coursework during your undergraduate years. You also may get the courses and hours required through Washburn's Master of Accountancy program or MAcc.

Admissions & Advising

Washburn faculty and staff are ready to help you plan your educational journey. Whether you are a freshman and starting out or an upperclassman who needs an advisor, we are prepared to answer your questions and continue to provide support.

In addition to your general business administration courses, your BBA in Accounting program includes 24 hours of accounting-specific courses, such as:

- Intermediate Financial Accounting I (AC321)

- Intermediate Financial Accounting II (AC322)

- Cost Accounting (AC325)

- Accounting Systems (AC330)

- Federal Taxation I (AC423)

- Auditing (AC425)

- 6 additional hours of electives in Accounting, Economics or Business

Freshmen and students new to the Brenneman School of Business should visit with Amber Ybarra initially for help in determining their degree track. Sophomores, juniors and seniors may choose a faculty member advisor.

Determining the correct catalog year is very important when using our advising literature. Catalog years dictate the requirements of your degree program and can change from year to year. These requirements will remain in force for up to seven years, or until the student decides to choose a newer catalog year. Sometimes it makes sense for a student to choose a newer catalog, while other times it’s more advantageous to use the older catalog. Regularly working with your advisor ensures you are following the right degree track.

Meet Accounting Graduate Katlin

Opportunity and affordability drew Katlin Othmer to Washburn. That and the fact that she loved math. The recent graduate made the most of her time as an Ichabod, earning a bachelor’s and master’s degree in five years.

“If I was at a bigger university, I think I would get lost in the sea of people,” said Othmer, who has a Bachelor of Business Administration in Accounting and Finance and a Master of Accountancy. “At Washburn, because of the small class sizes, you stand out, and I thrive off that positive reinforcement.”

In addition to receiving scholarships to lower the cost of her education, Othmer dove into campus life, volunteering in the community through the Leadership Institute.

“Washburn provided me with a lot of opportunities,” she said. “I’ve always loved to volunteer, so that’s something that was really important to me.”

A Topekan who works at Mize CPAs Inc. in the capital city, Othmer said she was well-prepared when she left Washburn.

“I felt really confident going into the workforce,” she said. “I draw a lot of parallels from what I learned at Washburn to what I do every day.”

By the Numbers

Experienced Salary

$79,220

Student/Faculty Ratio

20:1

MFT Scores

Top 5%

Program Cost

Washburn offers a competitive tuition rate. Both in-state and out-of-state students (Colorado, Missouri, Nebraska, Oklahoma and Texas) pay the same rate. Scholarships are available through both the Brenneman School of Business and Washburn University.

GET IN TOUCH WITH Brenneman School of Business

Physical Address

1729 SW MacVicar Avenue

Topeka, KS 66604

Mailing Address

1700 SW College Avenue

Topeka, KS 66621

Connect

785.670.1308

Fax: 785.670.1063

business@washburn.edu

![]()

![]()

![]()